INTERNATIONAL DOUBLE TAXATION ON FOREIGN DIRECT INVESTMENT IN LATIN AMERICA AND THE CARIBBEAN

LA DOBLE TRIBUTACIÓN INTERNACIONAL SOBRE LA INVERSIÓN DIRECTA EXTRANJERA EN AMÉRICA LATINA Y EL CARIBE

Abstract

His research work determines which are the effects of international double taxation on foreign investment in Latin America and the Caribbean, considering the results during the years 2008 to 2020, it is defined in monetary factors the effects and the cost of investment by country in which it is sought to determine the import when determining the subscription of double taxation agreements with the countries, demonstrating through a descriptive study that the greater the signature of international double taxation agreements, the more equitably the inflow of foreign investment resources to the destination country increases, favoring the country’s economy, influenced by negative factors caused by the affectation of the Coronavirus (Covid-19). The research was carried out under the descriptive research methodology, where the phenomenon of double taxation is analyzed from the economic perspective of direct investment versus the double taxation agreement. Legal regulations (double taxation treaties, concepts, jurisprudence), Scopus scientific journals, reports from international organizations (OECD) on international taxation and the analysis of related information in the theoretical framework were taken into account. From these valuable contributions are visualized, both for the academic community and for the States and international organizations that investigate the phenomenon of double taxation. Conclusions: Having networks of double taxation agreements for double taxation, shows an attitude open to the outside and receptive to the maintenance of economic relations that helps foreign trade, it is also evident that the greater the number of agreements signed by the Governments and clear fiscal policies on internal taxation of the countries foreign direct investment grows.

Key words:

international tax law, international treaties, government, taxation, direct investment, economy..Resumen

Este trabajo de investigación determina los efectos de la doble tributación internacional sobre la inversión extranjera en American Latina y el Caribe, al considerar los resultados entre 2008 y 2020. Se definen factores monetarios sobre los efectos y el costo de inversión por país en los que se busca determinar la importación al determinar suscripción de los contratos de doble imposición con los países, demostrando por un estudio descriptivo que, a mayor firma de convenios de doble tributación internacional aumenta igualmente la entrada de recursos de inversión extranjera al país, lo que favorece la economía, influyendo en factores negativos ocasionados por la afectación del Coronavirus (Covid-19). La investigación se realizó bajo la metodología de investigación descriptiva, donde se analiza la doble tributación con la óptica económica de la inversión directa frente al convenio de doble imposición tributaria. Se consideraron las normas jurídicas (tratados de doble tributación, conceptos, jurisprudencia), revistas científicas de Scopus, informes de organismos internacionales (OCDE) acerca de la tributación internacional y del análisis de la información relacionada en el marco teórico. De este, se visualizan aportes para la comunidad académica y para los Estados y organismos internacionales que investigan el fenómeno de la doble tributación. Se concluye con el estudio que disponer de convenios de doble tributación internacional muestra una actitud abierta al exterior y receptiva al mantenimiento de relaciones económicas que ayudan al comercio exterior, además se observa que a mayor número de convenios firmados por los gobiernos y políticas fiscales claras sobre tributación interna de los países crece la inversión directa extranjera.

Palabras clave:

derecho tributario internacional, tratados internacionales, gobierno, impuestos, inversión directa, economía..INTRODUCTION

International double taxation are barriers encountered by multinational companies and foreign capital when making investments in different countries, causing tax discrimination in some countries where their tax rates are high and their internal policies of international taxation seek to record the world income of Whether or not taxpayers find legal stability in Latin America and the Caribbean, which affects the national economy and the gross domestic product of the countries. Despite these border barriers in foreign trade, the fiscal policies of governments must be framed in the economic opening of the country to have a trade balance in imports and exports. There are previous studies that were analyzed in the research, such as Black (1974), Easson (2000) and Barrios et al. (2012), who define double taxation treaties as a network that must be eliminated, to capture foreign investment in the country, and prevent the profits of natural and legal persons from being recorded by two or more states, since States have the tax power to record income with their own tax regulations. Likewise, the developed countries seek to make the investment not in the country but abroad with the countries that are undergoing redevelopment. Therefore, economic dynamics require that double taxation agreements be negotiated between one or more countries in the treaty network. These dynamics seek to eliminate tax evasion and illusion in cross-border operations, where tax planning is aggressive in the international context. Its mode allows the Tax and Customs Directorates of the countries to be clear about the rules of the game for the internal taxation of foreign investment income. For this reason, the following question arises: Do international double taxation treaties influence foreign direct investment in Latin America and the Caribbean?

The research was carried out with the descriptive methodology, where the phenomenon of double taxation is analyzed from the economic perspective of direct investment versus the double taxation agreement. Legal regulations (double taxation treaties, concepts, jurisprudence), Scopus scientific journals , reports from international organizations (OECD) about international taxation and the analysis of related information in the theoretical framework were taken into account. From this, valuable contributions are visualized, both for the academic community and for the States and international organizations that investigate the phenomenon of double taxation.

THEORETICAL FRAMEWORK

International taxation is applied at a global level, where the contracting countries of the tax treaty agreements participate. In these, the regulation of national and global source income for the contribution of taxes is determined, according to Barrios et al (2012 ), the tax system is interpreted as a network where two countries define how the income of a country is channeled. country to another. The effects of the application of double taxation agreements have been analyzed in different studies using the database of the Organization for Economic Cooperation and Development (OECD) , on the flows of foreign direct investment in the countries, as Egger and Merlo point out. (2011 ). Barthel et al. (2010) conclude that foreign direct investment has positive effects on foreign investment in multinational companies. Blonigen et al. (2014 ), find positive effects of double tax agreements on foreign direct investment. However, Blonigen and Davier (2004), Egger et al. (2006), Egger and Merlo (2011), Blonigen et al. (2014 ), in investigations carried out, conclude that the effects of double taxation agreements are not conclusive on the growth of taxes and the origin of the agreements. The current models that are the negotiation guide for international double taxation agreements are stipulated by the Organization for the OECD and that of the United Nations Organization (UN). The bases of interpretation are contained in the Vienna Convention on the Law of Treaties, and the structure of the treaties contains the scope of application of persons and taxes. The section on the definitions of permanent residence and establishment, the income that contains the rules for taxation of interest, dividends, canons, capital gains and business profits, the Capital section, the section on double taxation and, finally, the provisions In general, this structure must be taken into account by the contracting countries when negotiating agreements.

Treaties against Double Taxation are characterized by the obligation of the States to ensure the nature of their internal laws in their respective jurisdictions, this is done to avoid the problems derived from the classification of dualist and monist systems.

The monist system does not need to incorporate a treaty as a law of national order, since it is based on the certainty that the instruments ratified internationally in some states by their internal law have precedence over local regulations, in order to provide legal certainty. to foreign investors. some examples of these systems are France, Japan, Luxembourg, Holland, Portugal, Spain and Switzerland.

The dualist system is the one that requires apart from the existence of the international treaty that validates the double taxation agreement and needs a norm of internal law that adopts it in the current legal system of each country so that it can be valid. This system is accepted by countries such as Australia, Canada, Denmark, India, Israel, New Zealand, Norway, Sweden and the United Kingdom. United. This dualistic system is the one used in Colombia, since in the article 224 of the Constitution National Policy describes this procedure.

The purposes that justify the creation of double taxation agreements are due to the specific need to provide alternatives and legal certainty to taxpayers who interact in a globalized world, since what is wanted to be avoided is that there is a double tax on the same event, that it does not cause tax discrimination, that a tax dispute resolution mechanism be created, that cooperation between states be strengthened to prevent tax avoidance or evasion.

For a correct interpretation of the treaties, three dates that have an important relevance to interpret the agreements must be taken into account, these are:

The date of signing the agreement: this date is taken into account to identify from what moment the tax situations covered by the treaty begin to be described.

The date of entry into force of the treaty: since there is an exchange of notes between the states that validate the agreement in a reciprocal manner, so that, depending on the validation system of the treaty, whether it is dualist or monist, there will be certainty of entry into force. validity of the agreement.

Effective date of each tax: The internal law of each state must be analyzed to determine the start and end date of the fiscal year of each state, since when a double taxation treaty or any tax rule is approved, whether it is internal law, it becomes effective in the following fiscal year.

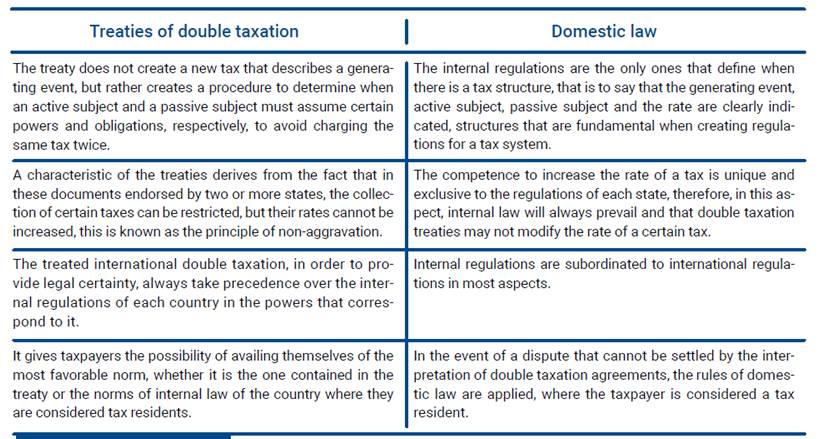

Between internal regulations and double taxation treaties, there is a series of powers applicable to all states. Some of the existing agreements include the agreement between the Government of the Republic of Colombia and the Government of the Republic of Italy, an agreement between the Government of the Republic of Colombia and the Government of the Republic of Panama to avoid double taxation, an agreement between the Government of the Republic of Colombia and the Government of the Republic of Panama to avoid double taxation, among others that have been negotiated with the states. Which can be synthesized like this:

Source: own elaboration (2021).

Table 1: Double taxation treaties and domestic law.

Interpretation of double taxation agreements

Double taxation treaties are interpreted according to international custom, which is embodied in the Vienna Convention that regulates the main aspects of the law of treaties. This convention was adopted by Colombia through Law 32 of 1985. The Vienna Convention is the central treaty for the interpretation of double taxation treaties, for example, article 31 of said convention describes the following rules:

1. A treaty must be interpreted in good faith in accordance with the ordinary meaning given to it. of attribute a the terms of treaty in the context of these Y having in bill its object Y finish.

2. For the effects of the interpretation of a treaty, the context will understand, what’s more of text, included its preamble Y annexes:

-

All agreement that I know refer to the treaty Y is been concerted Come in all the parts with reason of the celebration of treaty;

-

All instrument formulated by a either plus parts with reason of the celebration of treaty Y accepted by the the rest What instrument Referrer to the treaty;

3. Together with the context, there will be of to have in bill:

-

All agreement subsequent Come in the parts about of the interpretation of treaty either of the app of their dispositions;

-

All practice subsequently followed in the app of treaty by the which note the agreement of the parts about of the interpretation of treaty;

-

Allrule relevant of law international applicable in the relations Come in the parts.

4. I know give to a a finished a sense special Yes consists that such it was the intention of the parts.

Also in article 32 of the Vienna Convention, some complementary rules of interpretation are indicated, such as:

I know will be able go a media of interpretation complementary, in particular a the preparatory work of the treaty and the circumstances of its conclusion, to confirm the meaning resulting from the application of article 31, or to determine the sense when the interpretation Dadaist of accordance with the Article 31:

-

leave ambiguous or Dark the sense; either

-

drive a a result manifestly absurd either unreasonable.

The conflicts that may be caused by the difference of languages in which a treaty is implemented, are settled by the convention, since it indicates that when there are two languages in the international instruments, both will have the same prevalence, unless the parties agree on the prevalence of one language over the other.

Main double taxation agreement schemes

In the globalized world in which we find ourselves, international organizations have a great influence on international regulations. Therefore, some international models of some transnational state organizations stand out, such as the models to avoid double taxation of OECD Y the of the UN, both models can be used to negotiate agreements between two or more countries. However, in practice, it is observed that the number of agreements signed with respect to the OECD model, are more attractive for countries, because it contains the annexes of legal interpretation and understanding between the negotiators of the states. OECD double taxation scheme

Since 1955, a fiscal committee was created in the OECD, which created a draft agreement that was disclosed in 1963 and that in several meetings of the states that were part of the OECD, the fiscal affairs committee in 1977 issued a final version of said agreement. Since then, the double taxation model has been periodically reviewed, since the models must adapt to changes in international trade and the globalized society.

The OECD model has a clear purpose of providing legal certainty and promoting foreign investment. For this reason, the states that adhere to the guidelines of this organization must relinquish certain powers in tax matters. To a certain extent, this makes some states lower their collection levels, but this also means that they are more attractive to foreign investment because the tax rates are more beneficial.

This model has the purpose of favoring the State where the taxpayer has his fiscal residence, which allows greater ease for international trade and the collection of capital-exporting countries to the detriment of countries that receive foreign capital, although the latter attract greater foreign capital and investors.

UN double taxation scheme

In 1980, the UN created a model international treaty to avoid double taxation, to replace the manual for the negotiation of tax agreements between states. Said model was elaborated by a group of notables who generated a document where they wanted to prioritize international cooperation in tax matters. In 2003, this model underwent some modifications, and also in 2004 a statute was created that regulates the actions of the people who made up the committee of experts, which modified the agreement until 2011.

The main characteristics of this model lie in trying to balance the taxes of the States of the source of income and those originated by the country where the taxpayer has his fiscal residence, to favor withholding in the first more than in the second, that is, say try to benefit the State where the activity or resources that produce profitability are located.

The following UN scheme criteria are identified:

-

The income must be taxable on a base net, this means that the costs and expenses associated with the activity that produced the income from foreign capital must be taken into account.

-

Promote rates that do not discourage foreign investment to the extent that internal legal systems allow.

-

A procedure must be created to share the profitability between the states that receive the capital and the state where the taxpayer who owns the capital has tax residence.

Foreign direct investment impacts the fiscal policy for the economic development of a country and has an impact on various areas of the economy and tax revenues, countries with developing economies must be attractive for the countries that invest, they must consider several factors such as the political framework, the economy, the markets for goods and services, the costs and ease of investments. Castillo and López (2019) consider that the economic variables measure foreign investment and the fiscal policy variables that affect the location of investors, if the factors are not considered, direct foreign direct investment will be null. Van”t Riet and Lejour (2018) and Hong (2018) establish that many multinational companies divert resources from direct investment through a third country that provides the benefits to avoid the high tax rates of the host country on income. outgoing passive. Without the opening of international business and double taxation agreements, the economy in the countries would be affected by internal and global income since companies can invest in tax havens due to low tax rates and the reserve of data.

Braun and Weichenrieder (2015) and Schjeldrup (2016) determine that multinational companies demand secrecy in cross-border operations and profits obtained, from which the need for the network of international double taxation treaties is derived so that tax discrimination does not occur. between countries. Davies et al (2009) find a passive effect in the network of double taxation agreements when multinational companies locate subsidiary companies in a country with a treaty, keeping in mind the legal stability in the treaties. Marques and Pinho (2014), Murthy and Bhasin (2015) and Neumayer (2007) analyze the experimental method through foreign investment flows with economic indicators, trade openness, gross domestic product, inflation and other factors to determine the economic benefits of double taxation agreements.

METHOD

The research was carried out under the descriptive research methodology, where the phenomenon of double taxation is analyzed from the economic perspective of direct investment versus the double taxation agreement. According to Hernández (2006), descriptive studies seek to specify the properties, characteristics and profiles of any phenomenon that is subjected to this type of analysis. The descriptive method consists of analyzing the scope of the levels of association of one or more variables in a population from the main direct sources of study, among others. Therefore, legal standards (double taxation treaties, concepts, jurisprudence), Scopus scientific journals , reports from international organizations (OECD) about international taxation and the analysis of related information in the theoretical framework were taken into account. In this way, a research work was carried out that, in some way, is interesting and contains valuable contributions, both for the academic community and for the states and international organizations that investigate the phenomenon of double taxation.

RESULTS

Double taxation treaties in Latin America and the Caribbean

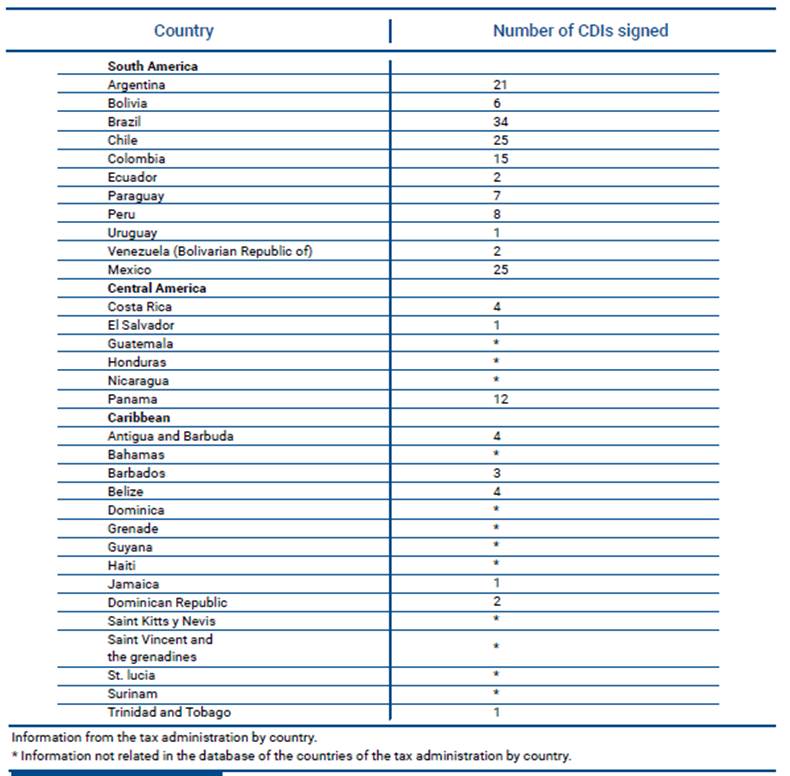

The signatures of the international double taxation agreements are fundamental for the different countries in order to have economic growth of the investments and in the countries that collect the resources of the investments for the economic development of the nation, the count of the agreements signed by the countries studied, to determine the implicit results of direct foreign investment in the countries they represent, if a greater number of signed agreements increases investment.

The following table shows the number of treaties signed to date by the different countries.

Source: own elaboration (2021).

Table 2: Number of agreements signed by country.

South American countries

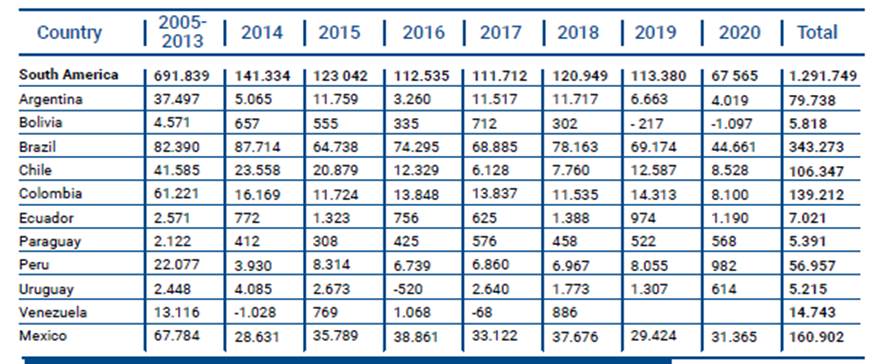

The following countries with the highest foreign direct investment received from 2005 to 2020 stand out, with Brazil being one of the countries with the best accumulated investment attractiveness of $79,738 million dollars, followed by Chile worth $106,347 million dollars, Colombia of $139,212 million dollars, Argentina $79,738 million dollars, Peru $56,957 million dollars.

These results are originated by several double taxation treaties signed in the last 15 years where the economy of the countries is sought to expand, and the internal fiscal policies that are defined in the different governments.

Next, the following table is presented with the countries with the highest foreign direct investment:

Source: Prepared by the authors based on foreign direct investment inflows in South America, (in millions of dollars). OECD (2021).

Table 3: Countries with the highest foreign direct investment.

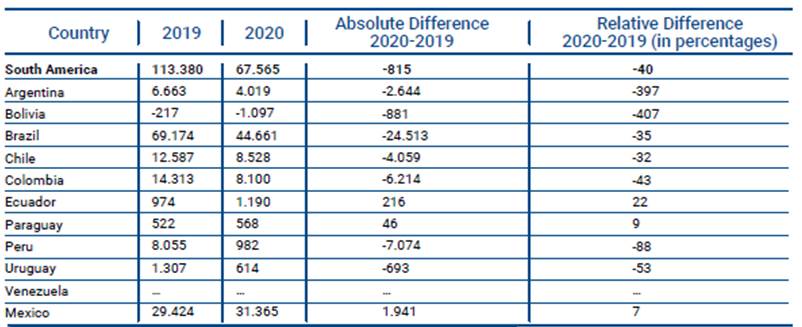

Regarding the countries indicated, it is highlighted that, as of January 25, 2022, the Council decided to take the first step to access, as a member of the OECD, Brazil, Argentina and Peru. Colombia was accepted in 2020 and Chile in 2010, the variations between foreign direct investments vary due to fiscal and strategic conditions for multinational transactions, and the benefits of the tax rates offered by the countries. The variations obtained during the last two years 2019-2020, as detailed in the following table due to the impact of the Covid-19 pandemic, which froze negotiations abroad, resulting in negative differences due to the impact.

Source: own elaboration based on the relative difference of foreign investment due to COVID in South America - OECD ( in millions of dollars) (2021).

Table 4: Variations 2019-2020 due to the impact of the Covid 19 pandemic.

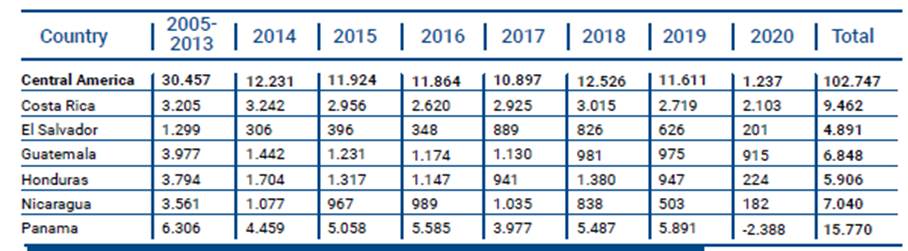

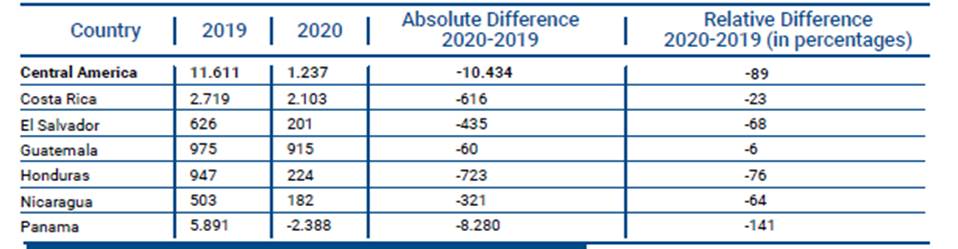

Central American countries

Among the Central American countries, the ones that stand out with the greatest reception of foreign indirect investment are the following: Panama with a total of $15,770 million dollars: followed by Costa Rica with a value of $9,462 million dollars; Nicaragua $7.040 million dollars; Guatemala $6,848, million dollars; Honduras $5,906 million dollars; and finally El Salvador $4,891 million dollars. The countries indicated are not currently members of the OECD, however, they have signed agreements with different countries outside the region.

Source: own elaboration from foreign investment inflows- OECD (In millions of dollars) (2021).

Table 5: Foreign direct investment inflows in Central American countries - OECD (In millions of dollars).

Regarding the situation experienced in the last two years due to Covid-19 over the year 2019, in Central America it obtained a total of $11,611 million dollars, and in 2020 $1.23 million dollars, presenting an absolute difference of $-10,434 and relative difference of -89.

Source: own elaboration from Relative difference in foreign investment due to COVID in South America - OECD ( in millions of dollars) (2021).

Tabla 6: Relative difference in foreign investment due to COVID in Central American countries- OECD ( in millions of dollars).

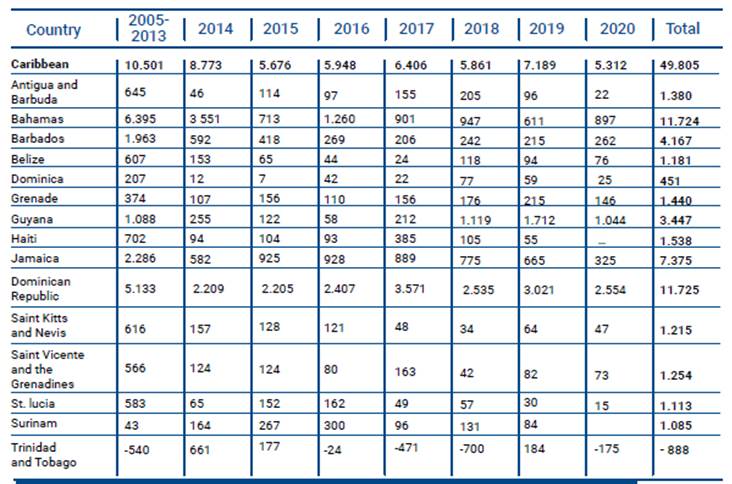

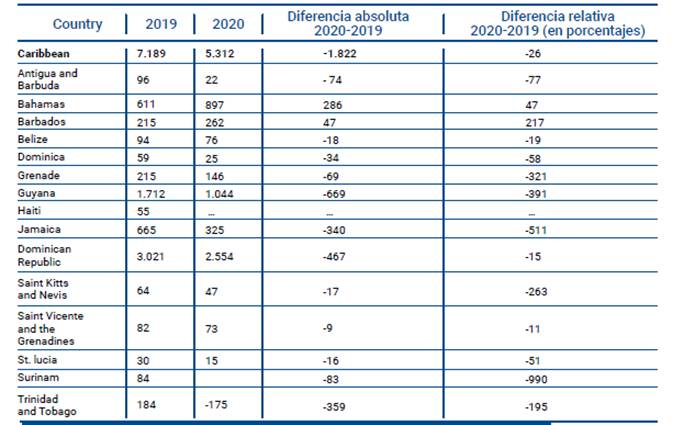

Caribbean floors

Source: own elaboration based on foreign direct investment inflows in Caribbean countries. - OECD (2021).

Table 7: Foreign direct investment inflows in Caribbean countries. - OECD (In millions of dollars).

Among the main countries with the highest indirect investment received in the Caribbean is the Dominican Republic, worth $11.725 million dollars; followed by the Bahamas for $11,724 million dollars; Grenada worth $1.44 billion dollars; Saint Vincent and the Grenadines for $1.254 million; and the other countries of the Caribbean. The countries indicated are not part of the OECD.

Source: own elaboration based on foreign investment inflows by Caribbean countries, - OECD (2021).

Table 8: Foreign direct investment inflows in Caribbean countries, - OECD (In millions of dollars)

According to the analysis of foreign direct investment in the face of the crisis caused by the Covid-19 pandemic, investment flows registered a greater drop during the years 2020 and 2021. This reduction significantly affected the negotiations of Latin American companies in all the fronts at an international level, due to the impact of the closing of the borders and , failing that, the decrease in direct investment abroad. In turn, the countries with the highest foreign direct investment are Brazil, Chile, Colombia and Mexico, maintaining this trend in the last five years. These contain a greater number of signed double taxation agreements benefiting from the advantages that tax agreements bring. The other countries, although they contain double taxation agreements, do not exceed twelve agreements per country as a minimum, which is reflected when receiving foreign direct investment.

Conclusions

The countries of Latin America and the Caribbean as a whole, of 33 countries, only three, which belong to the OECD, have been benefited by direct investment for the benefit of the treaties signed of international double taxation agreements with the different countries of the world. These benefits are quantitatively observed in the countries of South America, which received, from 2005 to 2020, a total of $1,291,749 million dollars; Central America $102,747 million dollars; and the Caribbean countries $49,805 million dollars.

In turn, the signed agreements represent a total of 178. And with respect to these, it is observed that, the greater the number of agreements signed by the Governments and clear fiscal policies on internal taxation of the countries, the foreign direct investment grows .

Based on these results, for future research, the political and economic factors that lead countries to take the position of negotiating double taxation agreements and canceling the agreements should be analyzed according to the position of the Governments.

Previous research has concluded that indirect investment increases as double taxation contracts are agreed, with the results shown as Barthel et al. (2010), Blonigen and Davies (2004), Blonigen et al . (2014), Castillo and López (2019), Braun (2016), Marques and Pinho (2014), Murthy and Bhasin (2015), and Neumayer (2007). Given the background, it is concluded that there is a positive effect on the country to the extent that the agreements are increased.

In a certain way, having networks of double taxation agreements for double taxation shows an attitude that is open to the outside world and receptive to maintaining economic relations that help foreign trade.